Almost there... Will SPY see 660 today? Trade Ideas for Mon Sep 15

Musks buys $1B of $TSLA at 390! Late Day flush yields 10x. Do you know what RSI Divergence is?

On Friday, SPY was mostly range bound and spent most of the day in a tight range! But that wasn’t a problem for THT PRO members.

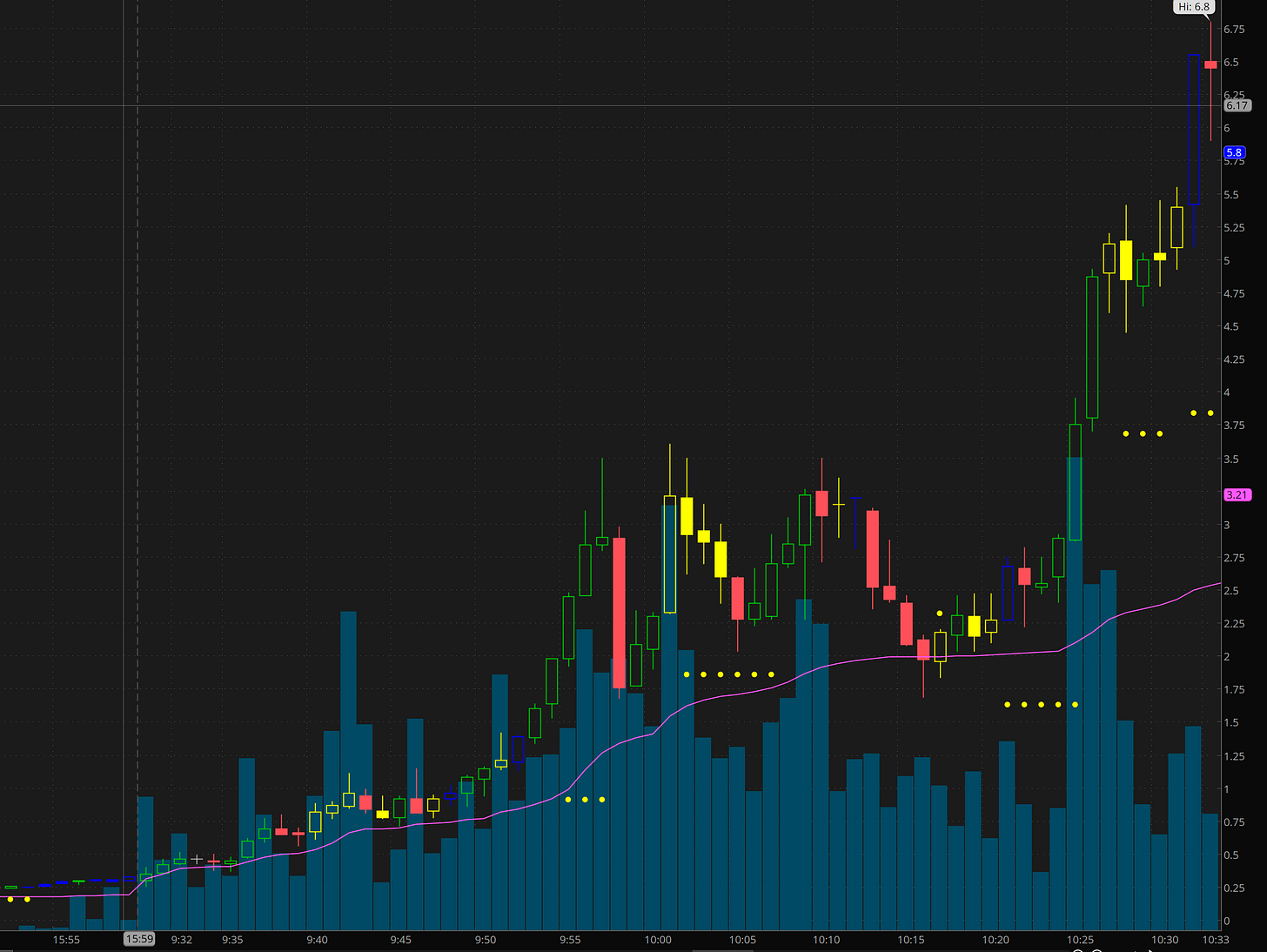

We swung TSLA long on Thursday and took new positions on Friday after we got an ORB15 range break. Taking TSLA 390c for 0.50-1 that ran as high as 6.80! Bay 11:00am it was mission accomplished for me!

I’m always experimenting and looking to improve. In the chart above do you see the yellow dots, that the predictive dip buy price to join trend on the options. Notice how it spiked to 3.50 and then predicted a 1.85 dip buy that came about 10-15 minutes later! Still experimental but I hope to add it to Edge Planner in a week or two after more testing.

This morning Musk announced he acquired $1B of TSLA 0.00%↑ at 390 and this morning TSLA gapped up to 430!

A few weeks ago, in a rare super swing, I alerted that I like 500c leaps and those are absolutely flying. If I recall I believe we got them for $10-15.

SPX on Friday

Unfortunately none of the trade ideas triggered, but using RSI Divergence and the custom GEX scanner I built and experimenting on, we were able to get SPX puts late Friday afternoon.

I alerted I taking 6595p for around 1.50 but the chart above shows the entry I wish I got on 6590p! I adding by chasing some at 3 when I saw the momentum.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Plan for Mon Sep 15

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Market Context

SPY shows a bullish bias in premarket, with price action consolidating above the pivot. The latest premarket close is 658.96, positioned above the previous day's close of 657.32 and near resistance at 658.75. Watch for failed breakouts or breakdowns at these levels for reversal opportunities.

Key Events Today

08:30 AM - Empire State Manufacturing Index - Measures manufacturing activity in New York State; expected -4.0, could influence market sentiment if deviates from forecasts.

Key Levels and Their Significance

663 - Projected R3 Resistance

661.80 - My gut feeling for resistance

660.30 - Projected Resistance

659.68 - High Priority: Resistance with potential for failed breakout reversal;

658.75 - High Priority: 50% chance of support hold

657.82 - Pivot point; 60% probability for support in breakdowns,

656.89 - Support from price action; multi-day low alignment with bounces, 55% probability, best for mid-session trades.

655.96 - Lower support; volume spike support in prior sessions, 50% probability for reversals, suitable for longer holds.

652 - Deeper support if a flush comes