After SPY rally, do we dip soon? -- Plan for Mon Dec 29

Our Bull Puts paid! AlphaOS is making Credit Selling and directional bets easy. Holiday trading = extra attention to avoid over trading.

Friday’s blog ideas were spot on!

Let’s combine the ideas with using AlphaOS.

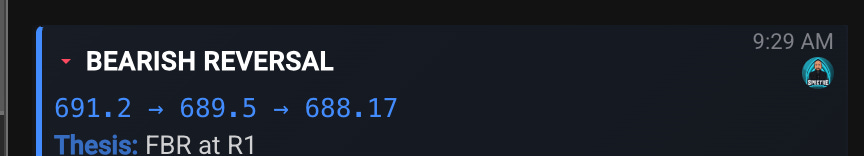

At the open we got the push setting up Idea #2.

We select the 691.20 bear idea. on the spike up over 691.20.

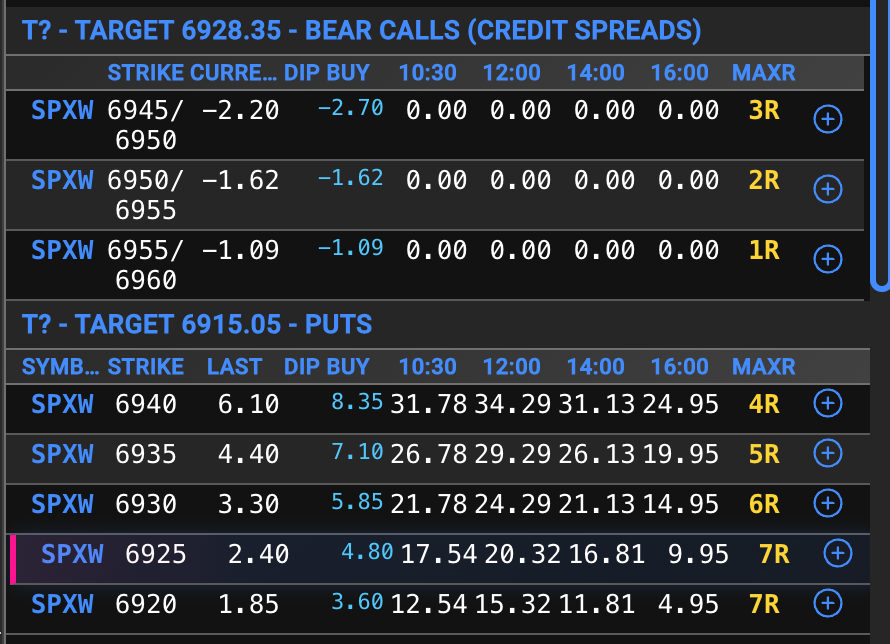

Here is how AlphaOS makes like easy….

Want to do credit spreads? choose any of these.. They all went to 0 by end of day. G950/55 bear calls $1600 credit recieved. no stress. or $2200 on 6945/50. Requires 5000 capital and 10 contracts. that is great return!

Want to do Naked Puts? Grab 6925p. (The pink indicates it’s getting love)

Here is what 6925p did! 2.5→8.5. That’s deserves a BOOM!!!

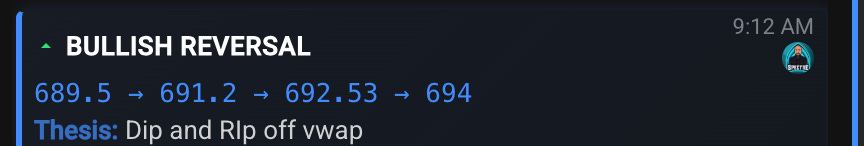

Later in the day we got a double bottom on the the High Probable Idea bounce off 689.50. So click the bullish reversal idea

Here are the contracts for that bounce. 6930c got love at 1.20

And we can take the 6925/20 bull puts. I also took 6920/15. Both won.

The 6930c give a nice 300%-400% rally before ending at 0.

So much of the math, searching, and figuring out which contracts for which strategy to take is taken away.

So much is now around recognizing the price action at the level, and then just picking which contract. Process simplified!

Process = Profits

Lately I’ve been doing the following:

Premarket establish where we likely wont reach. Sell premium for 0.8-0.60 on open.

After 11: second positioning of credit sells.

After 3:30: start hawking/planning for a Spectre Special

What’s a Spectre Special? A yolo trade that goes 300-1000% in under 30 min.

Credit Selling

SPX 6925/20 bull put - WON

SPX 6950/55 bear call - WON

NAKED Direction

none.

Spectre Special

none

If you are tired of overtrading, not knowing how to plan trades, and want to make more in less time, come join us.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Plan for Mon Dec 29

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

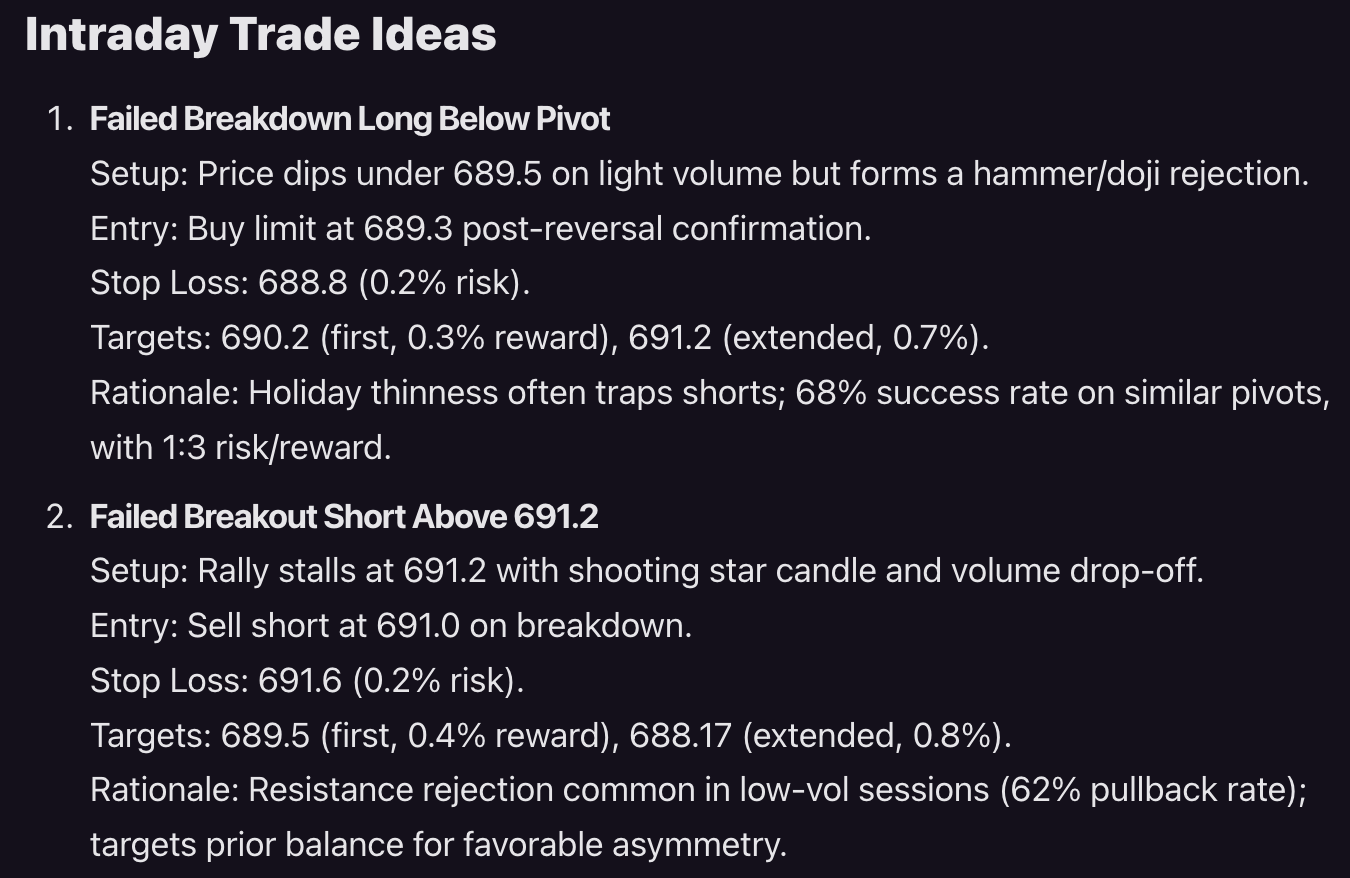

Spot failed breakdowns for quick 0.5% gains amid low-volume pre-holiday drift

Market Context

SPY rallied over the past five trading days, trading between 674.80 and 691.66, with recent sessions showing choppy action around the 688-690 zone. The index closed the previous session (2025-12-26) near 690, but premarket on 2025-12-29 opened lower around 688.61, suggesting a neutral-to-bearish bias with potential for failed breakdowns as buyers defend key supports. Chart patterns indicate a symmetrical triangle formation building since mid-December, with decreasing volatility and multiple tests of the 690 pivot—ideal for reversal plays if volume picks up post-open. Overall bias leans cautious, favoring shorts on failed upside breaks but longs on support holds, given the holiday-thinned liquidity.

Key Events Today

No major events scheduled today. Trading volume may remain light due to year-end positioning, increasing the risk of whipsaws around key levels.