After 4 days of selling, is market ready to rally? How I plan to trade the morning gap up on Thursday Jan 18

100-300% trade wanted. 1000% gainer trade SPX planned and delivered

What a day yesterday. It really tried my patience for some reason, but after taking a nap, I was fresh ready and got a 10 bagger trade.

Trades and Price Action Review

We started the day off with a gap down. So the first trade we are looking for is a gap down reversal after a failed breakdown. I think I took SPX

As you can see we got the bounce right off the 471 levels, but if failed to clear 472.50 so only a single level move.

We then got a triple top and failed breakout and I mentioned that 472 break should trigger downside. SPY broke 472, backtested in and then dumped all the way into 469s but missing the 469.50 target by 0.37. A solid plan/trade there.

The SPX 4730p went from $3 all the way to 16 on that. of if one waited for backtest for entry then $4. Almost perfect 2 level move!

If you entered at $4 and risked 50% then could selling for 3R would be $6 at $10. or if you waited for a triple (or 200% gain). selling at $12 is solid work.

I don’t recall my trade execution on this yesterday. I placed y bracket orders and went for a nap with a plan to come back online around 2:30pm. I had a strong feeling a 10 bagger was in the works.

I kept waiting, and was really struggling to find that 10x trade. As members saw I was barely commenting/alerting trades because I wanted the perfect risk/reward trade. I knew it was there.

The key thing here was recognizing the price action what it meant.

SPY did not get to 469.50.. that implied it is stronger than expected. SPY reclaimed 471 level. So I wanted a back test and ideally a dip back under 471 anticipating it will reclaim and we were in for a failed break down reversal move into today.

I was targeting 4735 and 4743 for the close in SPX.

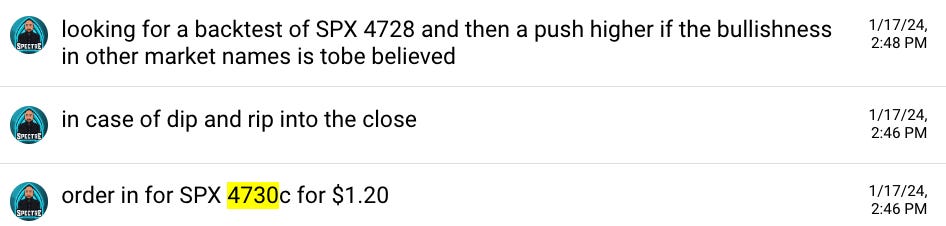

As such I alerted THE FOLLOWING

One of the things I’m especially proud of is my ability to forecast dip prices/entries. I was a little off from the low, but I alerted this entry price when the option price was around $4.70!

The time you decide on a direction/target for a trade should not be your entry. It is the time to plan your trade. Many times, you can get an entry at a significant discount to when you established your idea.

Planning the trade can change your outcome significantly. From taking a loss, to instead of making 50% gain, making 400% gain.

— Spectre

I’m running out of time, so will need to limit the price action review to SPY. suffice to say, many names yesterday implied a possible gap and go move today and more upside coming into Friday.

Plan for Thursday

Overall we are getting the gap up I’m looking for. The overall trigger for this bounce is a failed breakdown move off 470 and reclaim of the 9dma.

My bias is upside. The question is entry. If we have a gap and go setup then I’ll be looking for a dip into vwap after first 15 to 30 minutest to get long.

If we don’t get a gap and go I’ll be looking for 1 to 2 levels below the open to get long.

SPY

Looking for 473.50 dip and rip or cross and hold over 475 for 477 and maybe 480 into Friday.

AAPL

swinging 185c from 0.3 to 0.60 entry. likely sell 80% on open. might be moving with anticipation of Vision Pro launch plus market rally.

NVDA

Looking for profit taking initially and then want 580c

REMINDER: On gap ups in my favor, I like to take 50-100% off with in first 15 minutes and then reposition at a better price.

WARNING: Market makers maybe playing games and we could see a pop and yank. So I will stick to upside bias, but I will key an eye out for exhaustion and sell programs.