7 week rally! What's next? Plan for Mon Dec 18

Friday started off with a bang. I tend to wait for first hour and so missed much off the opening rally. But that is fine! Why because I know I am following my process and that the process works. That doesn’t mean every trade is profitable, but I know without doubt that if I keep planning and trading systematically according to process, I will be net profitable.

On Thursday, we took MSFT calls as a swing at 365/366 targeting a 370+ for Friday

My #1 Rule on trading the open.

If I take a swing trade overnight, and it gaps in my favor or quickly moves in my favor, I take profits on 50-100% of my position by the end of the first 15 minutes of the market, especially any spikes.

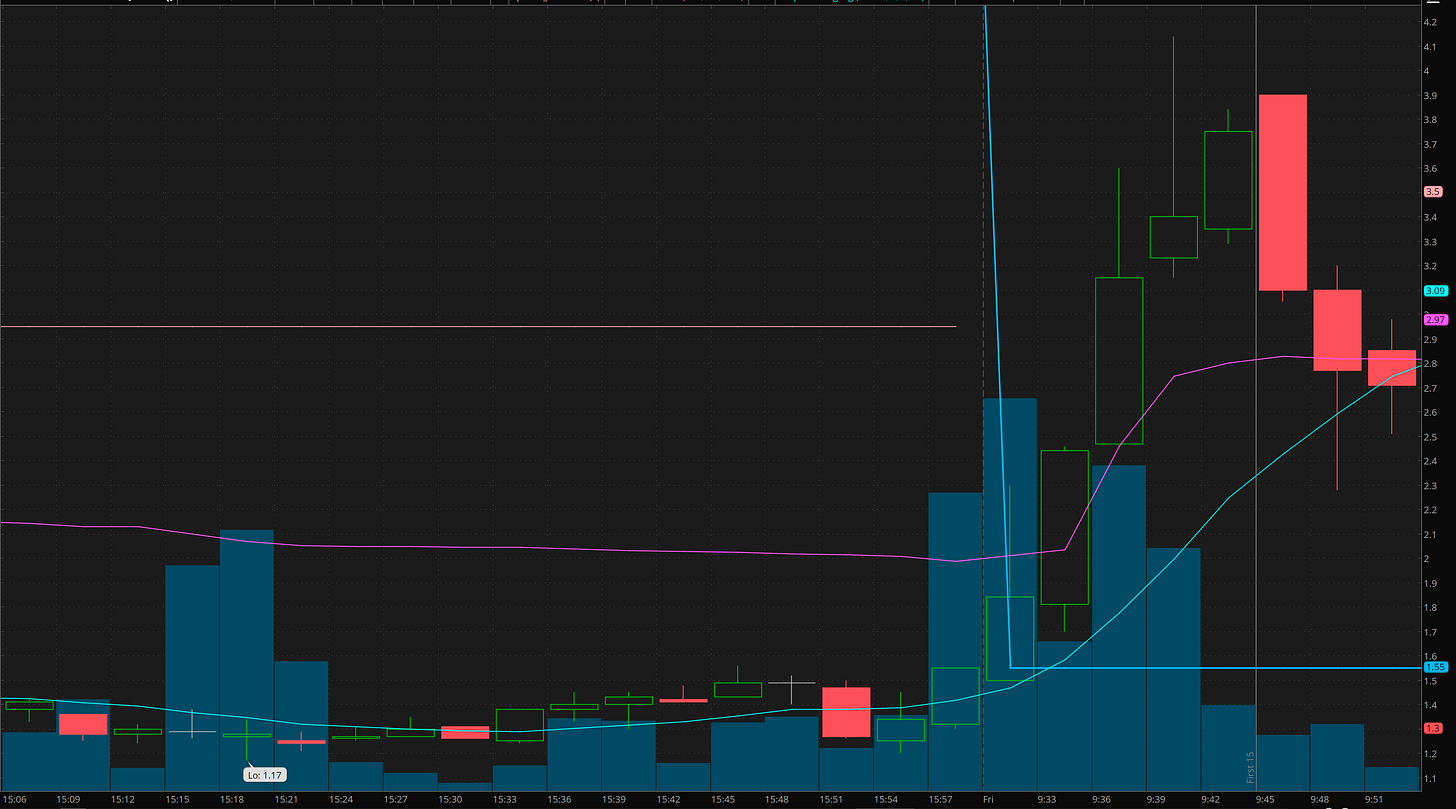

Let’s use MSFT for the example. Using my processing , I’m targeting 370+ based on the watchlist levels on Thursday. We scoop the 367.50c fro 1.20-1.40. Target sell of $3.20 to $4.50. (Notice how it’s not let me see what I can sell it for tomorrow, but I have a plan for profits)

In the first 15 minutes the contracts spiked to $4. There is no need to guess about selling. If you delayed just 5-7 minutes the contracts drop back under 2.50.

The opening action can be fast, so I highly recommend, place sell orders in advance at prices you are happy for profits at. Be systematic.

SPY PRICE ACTION REVIEW

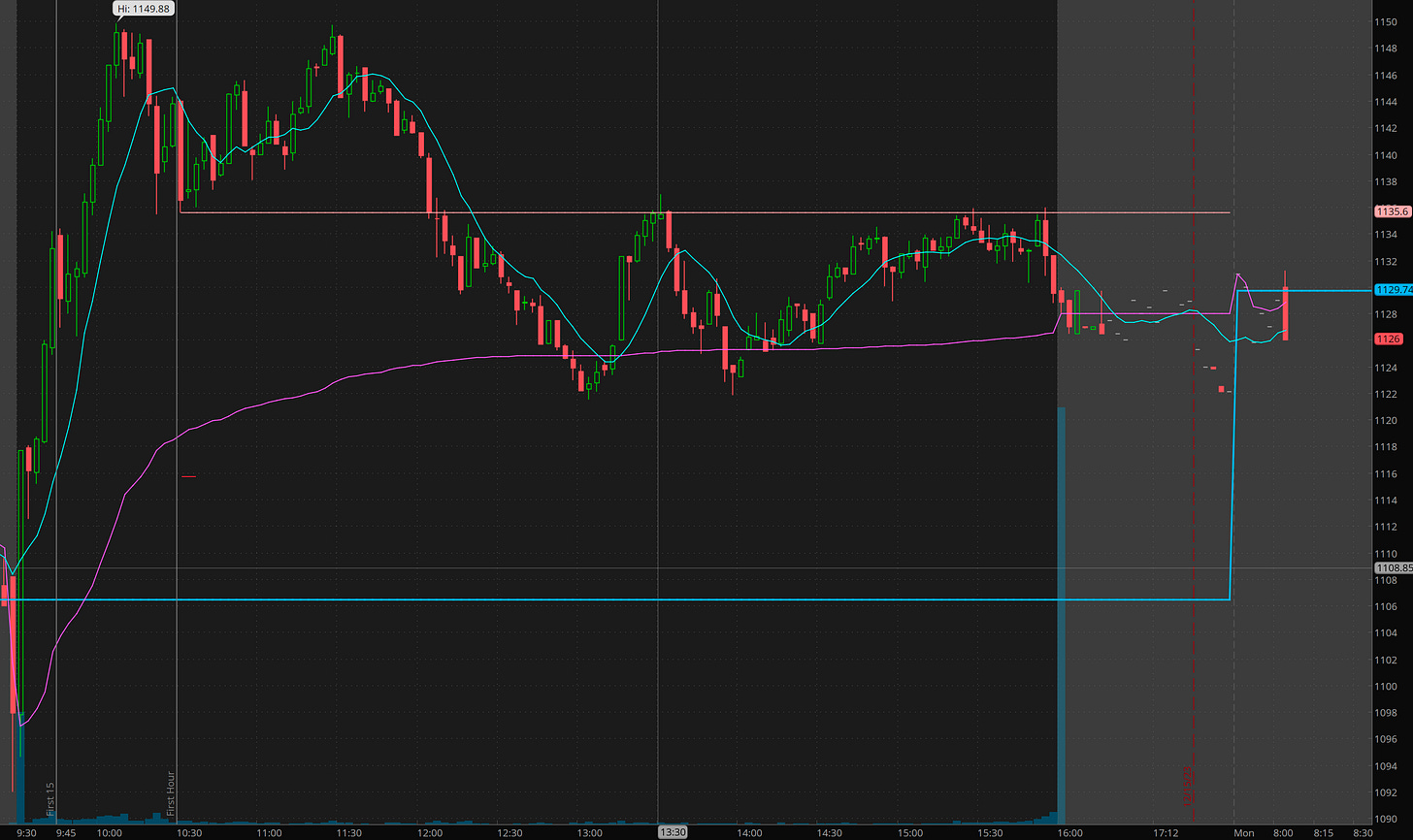

So SPY gapped down on Friday and overall was range bound.

This is typical of when it moves in consolidation. I would not be surprised if we consolidate a bit more now that the main catalysts for the year are out of the way.

The algo identified SPX 4715/4720 bear calls early and 4715/4710 bull puts. Which helped imply a tight range and interestingly enough we closed at 4719. Both positions had opportunities to exit for great profits.

In late afternoon I took a straddle on 4690p and 4720c which wasn’t spectacular. Basically yield 25% gain.

Overall the price action on Friday isn’t giving us a direction for this week. So we still to overall process. Buy dips and sell rips until range breaks come and then wait for confirmation.

AVGO gave the cleanest trade on Friday imho, though I was a little early on the entry.

The reason, for going short was using 1150 as a guide for rejection. Mostly because of instinct than anything else. I saw the double top forming and wanted to be in targeting vwap which means being able to sell for $10-20 depending on how quickly vwap rose. That would be 100-300% gain so we take the bet.

Here is what the contracts did.

From 5 popped for 10, dipped to 3.6 and ran to 19.

I like to lock in 50% on 0DTE when I get 100% to make it a risk free trade. Then you can let the trade work stress free.

Crypto gapping down

MSTR, COIN, RIOT, BTC are weaker after the weekend and are gapping down. This may be an indication of possible profit taking coming this week, to set up a rally for next week.

COIN

News is out that ARK* unloaded a bunch of COIN last week.

Given the recent rally, I’m watching pops this week for shorts/profit taking and a reset after the big run.

Plan for Monday Dec 18

I’m not looking for anything major to develop this week. Regarding SPY, I’d like to see a 2-3 pt dip develop today given weakness in crypto. Premarket action looks constructive / upside at the moment and it’s gapping up.

However, there has been non stop BTFD

SPY - thesis 468.60 test/break, flush 466, then look for a long. over 471, we could get a squeeze back toward 473, but I’ld like that to develop after a could days of basing.

NVDA - watching dips for a move over 500 by next week, but also open to profit taking since it has struggled with 500 level. we are in 490c swing from last week.

AMZN - watching dips for xmas rally

COIN - watching pops for a short, but if 142 bases, may consider a scalp long.

AFRM, UPST - watching pops for exhaustion to go short. way overbought imho.