5 Green Days and a monster rally. $SPY Chart review and plan for Monday

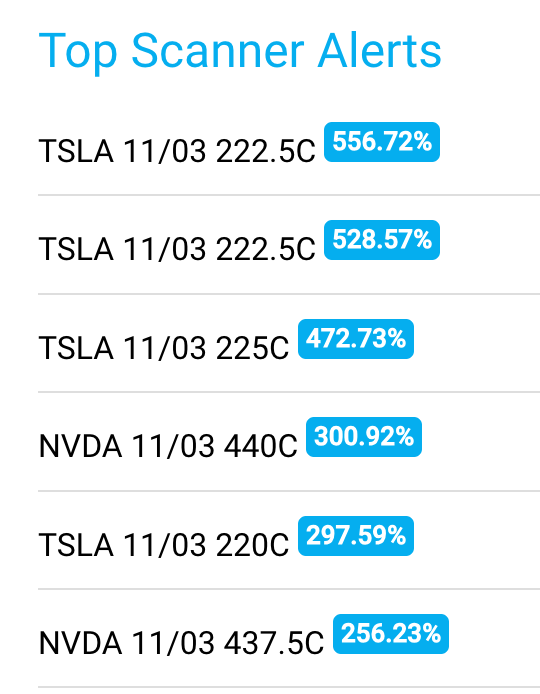

Edge’s Scanner picked up on a few good trades. Lately it has been very difficult to get 10x trades, but getting 2 to 5x has been doable.

TSLA ripped right to the 226 level which also turned out to be a huge short opportunity.

Remember to use the levels to plan trades. One of my favorite trade setups is a gap up and push into a level and then to get short once vwap is broken targeting the gap fill (solid blue line).

SPY 0.00%↑ Chart Review

Let’s take a look at the recent moves in SPY.

Key points:

We have recovered almost the entire sell off from 438

SPY reclaimed 420/425 key levels as well as that trending red line on Friday

Bonds are back under 5%

Bulls are back in control

I wasn’t expecting this much of a rally after FOMC. Definitely underestimated this move as I was operating o the belief that Bonds would stay over 5%.

If w see a push back over 5%, I will look for a sustained downside move, but until that or another catalyst, I’m expect choppy moves, with a melt up bias as long as we stay above 425.

My Plan for Monday Nov 6

I’m more wanting to scalp for a short move, its hard for me to join long without some sort of back test. So I’ll be looking for a reject off Friday highs, or one more leg up into 440-442 and then a fail to get short to back test 2 to 4 levels below.

In theory a backtest of 434 can come and we could dip as low as 425 and still remain bullish.

So they key for me will be to watch for upside exhaustion, ideally via a double or triple top with a failed breakout to get short.

If we dip into 433 and hold this morning, I may consider a long.

Key stocks I’ll be watching

NVDA 0.00%↑ - eyeing for a short scalp

MSFT 0.00%↑ - watching dips for more upside

AMD 0.00%↑ - watching if it clears or rejects 113

MDB 0.00%↑ - Has been basing, over 346 may trigger a start of some upside in coming weeks with e/r coming first week of Dec. Like for possible swing for e/r run up

Overall a number of stocks looking like they put in failed break down reversals and are hitting channel resistance or clearing above it.