3 days of selling/consolidation. Which way will FOMC take us? -- Plan for Wed Dec 10

Will SpectreAI be on point again today? Credit Selling pays again. No headaches, free money. Spectre Special delivered 5x to 18x!!!! SPX 6870c from 0.1-> 1.80!!! while SPX 6860 2->12 for 500%

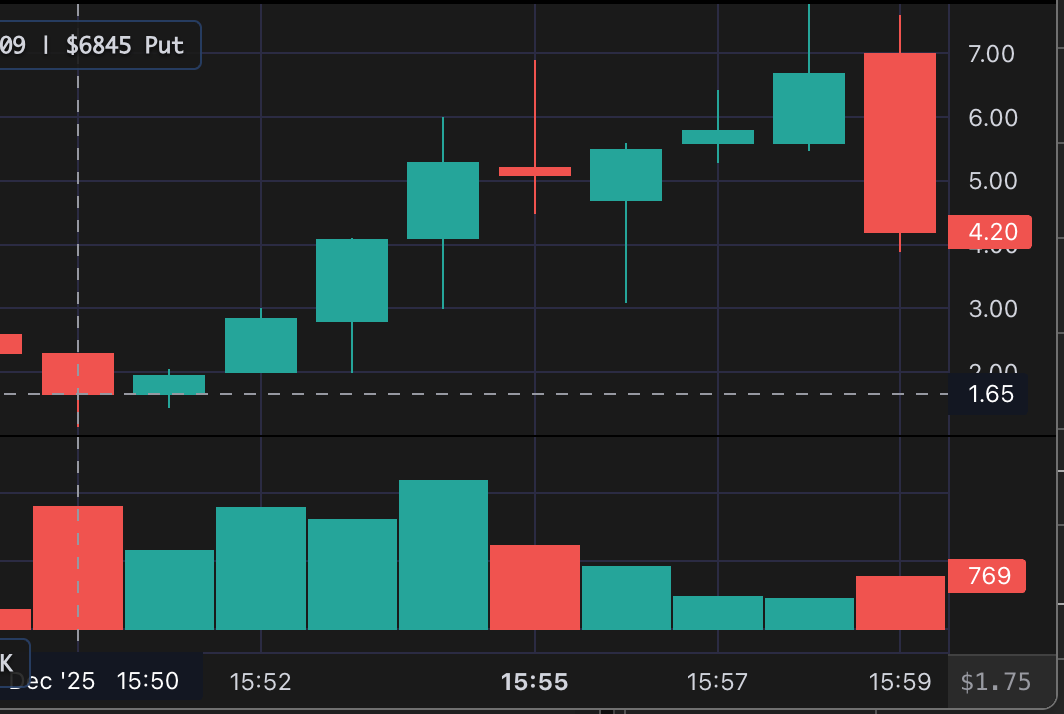

Nailed it.. Spectre Special SPX 6845p 1.50→6 on majority

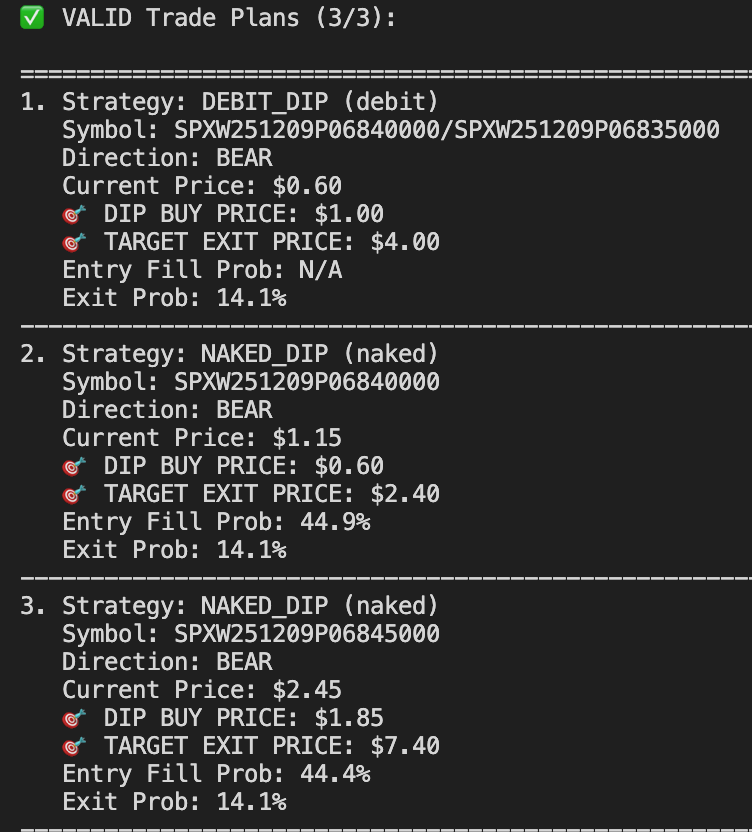

Here is what I’m working on/testing. Not yet in members hands but this was generated by back end at 15:15.

Here is what SPX 6845p did!

Exit Probabilities need work. It’s only considering one aspect.

Is a Santa Rally coming?

It sure does look like it. Market is expecting a rate cut, let’s see what the Fed does on Today. I would love a dip to 674-676 before rally starts (assuming it does)

Credit Selling

More solid work on Bull Puts and why I preach locking in gains ahead (depending on where the strike is)

I was took 2 bull puts yesterday.

SPX 6820/15 - won

SPX 6845/40 - won went from 1.70→0.4. out 0.60. If I didn’t. would have lost (this was an aggressive strike.

SPX 6835/30 would have been safer and went to 0 but the collection was 0.7. So I’m working on balancing that…

I’m not including by test trades that had mixed results and were part of my “core” credit selling process.

100% win rate on the day and done by 12.

VIDEO RECAP SPY/SPX on Dec 09

No video today.. sorry ran out of time.

If you are tired of overtrading, not knowing how to plan trades, and want to make more in less time, come join us.

What is Two Hour Trading?

Two Hour Trading is my system for finding and executing trades while spending less than two hours a day trading. My goal is to earn 100-300% on the capital I risk while waiting for 1000%+ gain trades to set up. Key benefits include:

High-quality trades with excellent reward vs. risk

Avoiding overtrading and losses from it

Trading to win vs. trading not to lose

Stacking the deck in your favor

If you are busy and want to see my commentary and ideas in real time consider joining THT-PRO.

Plan for Wed Dec 10

Stick to process. The process and trade setups I teach works. Rinse and repeat over and over again. There will be losses. Any good system will have them. Being systematic also means the gains will repeat and come again too. If you keep changing your system/process trying in an effort to never lose a trade, you will never get to where you want to go.

Survive FOMC Chaos: SPY’s Survival Zones

Lock in profits amid Fed uncertainty with precise reversal setups targeting 1-2% moves.

Market Context

SPY has been grinding higher in a choppy range over the past week, closing the previous session at 683.81 after testing highs near 688.39 and pulling back from lows around 679.20. The chart shows a bullish bias with repeated bounces off the 681.9 support zone, forming a series of higher lows since early December, but momentum is stalling near the 684.78 resistance as premarket action hovers around 683.76. Volume spikes on pullbacks suggest institutional buying, but the impending FOMC decision could trigger volatility—watch for failed breakouts above 686.53 to confirm continuation or breakdowns below 681.9 for a risk-off shift. Overall, the setup favors range-bound trading with upside potential if the pivot at 683.64 holds, but expect whipsaws around the 2:00 PM announcement.

Key Events Today

8:30 AM ET: Employment Cost Index (Q3, delayed) – Actual: 0.8% vs. Forecast: 0.9%, Previous: 0.9%. A softer-than-expected reading could pressure yields and boost SPY, signaling cooling inflation ahead of the Fed.

2:00 PM ET: FOMC Interest-Rate Decision – Markets price in a 90% chance of no change, but hawkish tones could spark downside. Position sizing is key to avoid whipsaws.

2:00 PM ET: Monthly U.S. Federal Budget (November) – Forecast: -$137.3B vs. Previous: -$367B. Wider deficits might weigh on sentiment if higher than expected.

2:30 PM ET: Fed Chair Powell Press Conference – Watch for forward guidance on rates; dovish comments could propel SPY toward 686.53, while hawkish rhetoric tests 681.9 support.

These events cluster in the afternoon, so morning sessions may stay range-bound—trade lightly until post-FOMC clarity emerges.